Chinese auto firms follow Tesla to Mexico, and from there to the U.S.

Auto and auto parts makers setting up nearer Elon Musk’s main EV market — North America — must navigate challenges to avoid U.S. barriers.

In February, Mexican President Andrés Manuel López Obrador announced a new Tesla factory would be built near Monterrey in the northern state of Nuevo León. Investment in the plant will exceed $5 billion and have an annual production capacity of 1 million electric vehicles (EVs), Mexican officials said.

The move will allow Elon Musk’s EV juggernaut to sidestep steep tariffs imposed on imports from China and unfavorable fluctuations in logistics costs.

The new factory in Mexico presents a choice to Chinese auto suppliers servicing Tesla’s Shanghai plant — move to Mexico, too, or risk losing orders worth hundreds of million of dollars.

Months later, industry insiders said that Chinese firms were willing to go out into the world, especially as Tesla, allegedly, encouraged them to tag along. The opportunity was massive. The Shanghai and Monterrey plants would each contribute around half of Tesla’s annual vehicle production capacity.

The scale of the Monterrey factory means that Chinese suppliers across Tesla’s supply chain began packing up. Upstream, JL Mag Rare-Earth, a producer of magnets used in electric vehicles (EVs), said it would construct a recycling plant in Monterrey to aid in the manufacturing of its magnets. Similarly, Xusheng Group said it would replicate its industrial chain to make aluminum alloy auto parts about an hour from Monterrey.

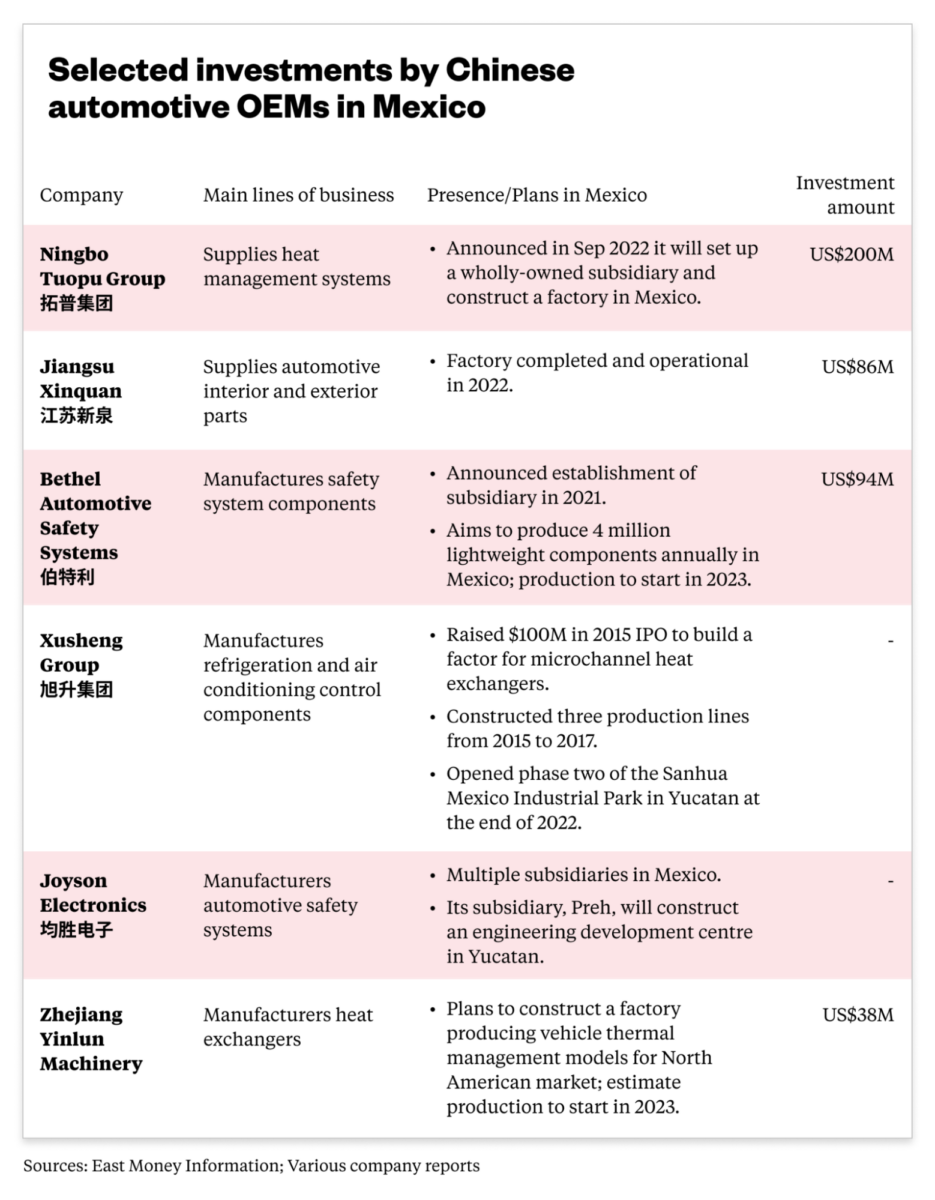

JL Mag and Xusheng are not isolated investments, nor are Chinese original equipment manufacturers (OEMs) brand new in Mexico. At least 26 already have a presence in Mexico or have announced plans to expand their presence in the auto sector, mainly in the Monterrey area.

Larger manufacturers such as Xusheng Group set up in Mexico in 2015, while smaller OEMs began to establish subsidiaries in 2020.

Pandemic business

The influx of Chinese auto suppliers into Mexico following Tesla’s announcement is not a new trend. From around 2020, Chinese automakers and auto suppliers have been relocating production to Mexico, driven in part by short term hikes in logistics costs and long term considerations of trade barriers.

At the end of 2019, it cost around less than $2,000 to ship a twenty-foot equivalent unit (TEU) container from Shanghai to the U.S. West Coast. A little more than two years later, in early 2022, the same route quadrupled to around $8,000/TEU. Dramatic increases in shipping costs during the pandemic provided substantial motivation for Chinese firms to produce much closer to their customers.

Even as shipping prices begin to bottom out in early 2023, Chinese auto OEMs continue to enjoy substantial cost savings by leveraging tariff advantages from the U.S.-Mexico-Canada Agreement (USMCA) and to bypass tariffs on Chinese made goods imposed by the Trump Administration and extended to today.

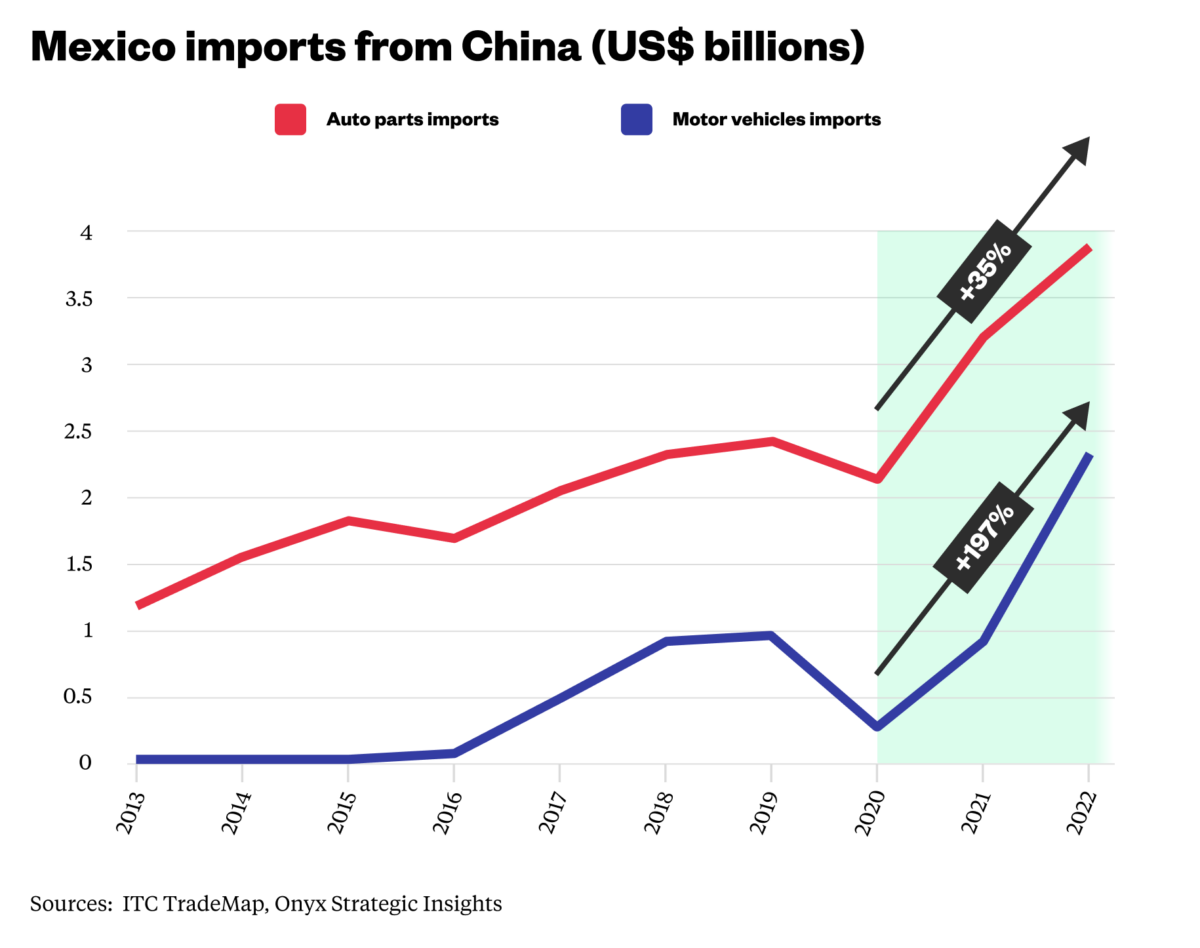

As such, Mexico’s imports of Chinese auto parts grew over 30% from 2020-2022, feeding into Chinese production in Mexico, while imports of motor vehicles nearly doubled to service Mexico as an end market for Chinese automakers.

Cutthroat competition

While trade diversion and lower shipping costs guide the flow of Chinese auto firms to Mexico, the largest motivating factor is the brutal competition within China’s domestic auto market. China’s auto market is crowded — around 20% of its 148 car brands hold 90% of the market. An ongoing price war led to only 10 companies turning a profit in the first quarter of 2023.

The intensity of this competition means that 60-70% of auto brands in China will be eliminated in the coming two to three years, according to Zhū Huáróng 朱华荣 , chairman of Changan Automobile.

In contrast, the growing U.S. EV market presents an alternative for survival. EV sales are predicted to rise to 52% of all U.S. auto sales by 2030 from around 5% in 2022, buoyed by Inflation Reduction Act (IRA) incentives. Chinese EVs cost less than their American and European counterparts, appealing to price-sensitive consumers in the North American market.

Presented with this opportunity, Chinese automakers have begun moving. In April, Chinese truck maker Foton announced it will partner with Chinese battery producer CATL to manufacture traditional cars and EVs for export to the U.S. NIO, another Chinese EV maker, plans to enter the U.S. market in late 2025, leveraging its lower price point to compete with pricier brands such as Tesla.

The Chinese automakers’ efforts could face substantial headwinds from the political climate in the U.S. Since March, U.S. IRA consumer tax credits for EVs mandate that at least 50% of the components of an EV battery must be made in North America, and 40% of minerals used to make the batteries must come from domestic sources or from countries with Free Trade Agreements with the U.S. Both hurdles will rise incrementally through 2029, effectively shutting out Chinese carmakers that source Chinese batteries and minerals.

However, Chinese automakers could technically still qualify for IRA credits if they choose to lease their EVs to U.S. consumers, even if the vehicles contain non-IRA compliant materials. This loophole means that Chinese automakers could pursue a leasing strategy in the U.S. market going forward.

Easing the process

For Chinese auto firms who have decided to move, relocation is not an easy endeavor. They grapple with a substantially different work culture and a whole new set of regulations on top of a language barrier. These difficulties are neither new nor insurmountable. In previous years, U.S. auto firms used shelter services for their maquiladoras — factories set up in Mexico to make cars or export to the U.S. These shelter services manage the administrative and legal burdens for their clients, foreign companies, and reduce the red tape that comes with entering the Mexican market.

In this age of Chinese relocation, commercial firms have also sprung up to pave the way for interested automakers, furniture builders, and other enterprises. Hofusan, a sprawling 850-hectare industrial park in the state of Nuevo León, is perhaps the most well-known of the Chinese shelter services. Formed as a joint venture between China’s Holley Group, Futong Group, and Mexico’s Santos family, Hofusan offers accounting, labor management, expat support, and import and export services to its clients.

Its services have proven relevant for this new wave of Tesla suppliers. In March this year, Anjie Technology, an electronics manufacturer, said it would purchase land in Hofusan, following the entry of other furniture and electronics firms.

Beijing has also buttressed available commercial support. Although not directed specifically towards the auto sector, the central government offers financial incentives that reduce risk and lower cost hurdles for Chinese firms to expand overseas. These include favorable loans and overseas investment insurance, tax breaks, and simplified regulations that create a conducive environment for internationalization.

These measures suggest that reshoring to Mexico and other locations is at least sanctioned, if not actively encouraged by China’s central government.

Bringing in and going out

Just as geopolitical considerations and industrial incentives have long shaped the supply chains of major Western multinationals with decades of experience offshoring production, Chinese firms now are learning to respond to the same pressures.

“Industries in China are already walking on the two legs of ‘bringing in’ and ‘going out”, according to Péng Péng 彭澎, executive chairman of the Guangdong Society of Reform, a government-affiliated think tank. Armed with the dual objectives of diversifying their revenue sources (bringing in) and expanding overseas (going out), the presence of Chinese automakers in Mexico is poised to grow exponentially in the coming years.

Companies:

- Tesla

- Changan Automobile

- Ningbo Tuopu Group 宁波拓普集团

- JL MAG Rare-Earth 金力永磁

- Xusheng Group 宁波旭升集团

- Jiangsu Xinquan 江苏新泉汽车

- Foton 福田汽车

- CATL

- NIO

- Holley Group 华立集团

- Futong Group 杭州富通集团

- Anjie Technology 苏州安洁科技

Links and sources:

- How Mexico’s Nuevo León State Landed Tesla’s First Plant In Latin America / Bloomberg Linea

- 36氪独家丨特斯拉动员中国供应商出海,去墨西哥复制“上海工厂” / 36Kr

- Tesla Encourages Chinese Suppliers to Open Factories in Mexico: Report / Tesla North

- 2022 Q4 Tesla Quarterly Update / Tesla

- China’s JL Mag to Build USD100 Million Rare-Earth Magnet Recycling Facility in Mexico / YiCai Global

- 美国汽车生产“后花园”!国产汽零出海瞄上墨西哥,这些厂商已抢先布局 / Shanghai Zhengjian Communication

- Price War Squeezes Chinese Carmakers With No Relief in Sight / Bloomberg

- Competition to Kill Off Up to 70% of Car Brands in China in Two, Three Years, Changan Auto Chair Says / YiCai Global

- China has a 10,000 euro cost advantage in small EVs, auto supplier says / Reuters

- Chinese Truckmaker to Boost Mexico Presence With Eye on US Market / Bloomberg

- Chinese Tesla rival Nio plans US EV sales by 2025 as it outlines global ambitions / South China Morning Post

- New Rules Will Make Many Electric Cars Ineligible for Tax Credits / New York Times

- 山西400亿专项信贷助力企业“走出去” / China National Radio

A Tax Loophole Makes EV Leasing a No-Brainer in the US / Bloomberg - Shunned by US, China investors use Mexico to keep grip on North American market / South China Morning Post

Views expressed in the article are the author’s own and do not reflect the views of Onyx Strategic Insights or Expeditors.