Ozempic craze hits China as first GLP-1 weight-loss drug is greenlighted

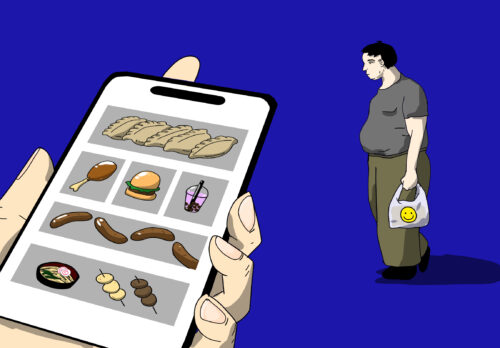

The approval is significant because it opens the door to an expanding, groundbreaking class of drugs for thinness-obsessed Chinese people who are looking for quick weight loss.

China has for the first time authorized a drug originally designed for patients with diabetes to be sold for weight-loss purposes, a move likely to pave the way for diet medications that have previously taken the world by storm.

The approved drug is an injection called lìlǔpíng 利鲁平, produced by Hangzhou-based pharmaceutical firm Huadong Medicine. It is a type of glucagon-like peptide-1 (GLP-1) receptor agonist, which works by mimicking an intestinal hormone that reduces appetite and improves insulin secretion.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Generically known as liraglutide, Huadong’s version was first approved for blood sugar control in the treatment of Type 2 diabetes in March. Then in an announcement on Tuesday, the drugmaker unveiled that the National Medical Products Administration (NMPA), China’s top drug regulator, had allowed the injection to be used in weight reduction, making it the first GLP-1 receptor agonist officially available in the country for people who wish to lose weight but for diabetes-unrelated reasons.

Liluping is appropriate for “adult patients who need long-term weight management,” and can be considered as “a treatment in addition to a low-calorie diet and increased exercise,” Huadong Medicine said in the notice. “As of now, we have launched commercial sales of the injection and are actively pushing it to be listed by online pharmacies and stocked by hospitals around the country,” the company added.

It’s unclear for now whether the domestically produced slimming jabs are prescription only or not. According to local media reports, given how the NMPA managed similar medications in the past, it’s highly likely that weight-related eligibility requirements will be applied. But despite the incomplete information regarding its rollout, the product has already ignited curiosity and enthusiasm on the Chinese stock market, with Huadong Medicine’s shares on the Shenzhen Exchange surging about 3.4% on Wednesday.

“This class of GLP-1 weight-loss drugs is going to be a blockbuster. We’ve already seen sales for those in peak globally and this just shows you that China can get stuff approved as well,” Derrick Li, a managing director at Baird Capital who specializes in the global landscape of biopharma and healthcare, told The China Project. “It’s important for China as it thinks about being a bigger global player.”

Hollywood’s worst-kept secret

With the recent approval, Huadong Medicine is now poised to capitalize on a worldwide frenzy surrounding miracle drugs for weight loss, which first became a sensation among Hollywood celebrities last year and gained fans in China in the past few months.

At the center of the craze is Ozempic, a branded name for semaglutide, which is a modified version of liraglutide — the main active ingredient in Liluping — but requires less frequent jabs for the same results. FDA-approved in the U.S. in 2017 and by the EU in 2018, Ozempic is developed and sold by Danish pharma juggernaut Novo Nordisk, and was originally meant for patients with Type 2 diabetes. Injected once per week into the stomach, thigh, or arm, the insulin-regulating medication makes users feel fuller for longer and suppresses their appetite. In 2021, Wegovy, another brand of semaglutide by Novo Nordisk, was approved in the U.S. and U.K. to treat chronic obesity.

It’s perhaps no surprise that semaglutide first took off in Hollywood, where many celebrities have turned to controversial methods at some point to lose weight in short time frames. Described as the worst-kept secret in showbiz, the drug reportedly saturated the scene over the course of a few months, with doctors prescribing Ozempic off-label for weight loss and celebrities taking it left and right.

While most famous people appear to have kept quiet about the popular drug or even vehemently deny that they’ve used it, a handful have been open about taking the medications, such as Tesla CEO Elon Musk and comedian Rosie O’Donnell. The use of Ozempic was so ubiquitous in the American entertainment industry that it received a mention at the 2023 Oscars, where Jimmy Kimmel joked onstage, “Everybody looks so great. When I look around this room, I can’t help but wonder, ‘Is Ozempic right for me?’”

Since then, talks of Ozempic have exploded all over the internet. On TikTok, videos tagged #ozempic have racked up hundreds of millions of views, with some medical professionals blatantly promoting the injection alongside accessible beauty services like shots of Botox and laser hair removal. As the drug soared in popularity, people with diabetes reportedly had to ration their Ozempic doses to deal with a global shortage.

A race to slim down China

But the U.S. isn’t the only place obsessed with the hot drug. In China, where Ozempic was officially approved in April 2021 exclusively for diabetes, there has been a tremendous surge of interest in the injection on social media platforms like Xiaohongshu, with users flaunting their Ozempic-assisted shrinking figures and sharing tips on how to get the shots by faking prescriptions or through illicit peddlers.

According to CNN, Ozempic reported sales of 303 million Danish kroner ($44 million) in China in the nine months after its launch in April 2021. The next year, sales in the country soared more than sevenfold, reaching 2.2 billion Danish kroner ($320 million).

As demand for Ozempic increased in China, so did its price. While a 1.5 mg Ozempic dose costs around 500 yuan ($69) in public hospitals, it’s been sold on ecommerce sites like Taobao for as high as 1,000 yuan ($138). As in the U.S., the rise in people using Ozempic off-label has also limited access for Chinese patients with diabetes who rely on it to control their blood sugar.

Riding on this wave of skyrocketing interest, Novo Nordisk applied to China’s drug regulator in June to widen the scope of use for semaglutide. Although details about the application haven’t been revealed, many industry experts believed that it would be for weight loss.

Meanwhile, a slew of Chinese companies have also set their sights on the weight loss drug market that analysts predict will boom in coming years. Leading this crop of domestic challengers is Huadong Medicine, a comprehensive pharmaceutical firm founded in 1993 and headquartered in Hangzhou. In June 2021, Huadong Medicine applied to the State Intellectual Property Office to invalidate Novo Nordisk’s patent for semaglutide in China, which was originally scheduled to expire in 2026. In September 2022, the government ruled in Huadong’s favor, but Novo appealed that decision.

If the ruling is upheld, a flurry of Chinese drugmakers will introduce their own versions of Ozempic and put Novo in a disadvantageous position. But for now, the approval of Liluping as a weight-loss drug is a development big enough to shake up the industry and “get a conversation started,” said Li from Baird Capital.

“I’m kind of curious to see what would happen if the NMPA will approve Ozempic to go head to head with a local Chinese company. In other classes of drugs, the Chinese regulators weren’t as friendly,” Li said. “Depending on the pricing of Hualong’s drug, it can make it very interesting on the global sales.”

A wonder drug to combat China’s obesity problem

In Huadong’s statement about Liluping, the injection is largely introduced as an effective tool to fight China’s obesity problem rather than an aesthetic choice. Citing 2020 research conducted by China’s National Health Commission, the company noted that over half of the country’s adults were overweight or obese, which was described as a “severe” issue by the commission’s deputy director Lǐ Bīn 李斌 at the time of the report’s release. By comparison, in 2002, around 23% of Chinese adults were overweight, and only roughly 7% were obese.

Before 2022, “Orlistat capsules were the only medication approved in China for treatment of obesity and overweight, which left a massive clinical need for compliant, safe, and effective weight control drugs unmet,” the company wrote.

Worrying about increases in heart disease and other weight-related conditions, the Chinese government has made obesity prevention a priority in its national healthcare blueprint, known as “Healthy China 2030,” which it announced in 2016. As part of the efforts, local food companies have been encouraged to produce snacks and beverages that are low in fat and sugar, while schools have been ordered to include more physical fitness classes in their curriculums.

For the Chinese weight-loss industry, the government’s heightened concern about obesity means big business opportunities. For example, weight-loss camps — which require participants to step away from their usual lives and stay in a structured environment for months with mandatory exercise classes and prepared meals — have been springing up across the country, despite questions about their effectiveness raised and reports of deaths.

But for the majority of China’s population, losing weight appears to be more of an appearance-enhancing pursuit. As in much of Asia and the rest of the world, thinness is still considered the standard for attractiveness in China. And despite a growing awareness and support of the body-positivity movement, Chinese social media remains awash with unhealthy and unrealistic trends of women showing off their thin physiques, including one that saw adult women squeezing themselves into childrenswear, wrapping their grown bodies in tiny tops that accentuate their slender figures.

GLP-1 weight-loss drugs like Liluping are positioned to cash in on this undying national obsession with thinness. “In all Western markets, weight-loss drugs are definitely something that are utilized very often, and they’ve become pretty expensive,” Li said. “There are 1.5 billion people in China and I think a good amount of people can utilize it. And the price point can be something that’s really powerful.”